Palm Springs coronavirus business resources webinar

Mayor Geoff Kors, the Palm Springs Chamber and the California Small Business Development Center (SBDC) hosted a Coronavirus Business Resources Online Town Hall and webinar today at 1 p.m.

The webinar helped explain available resources, funding options and more for area businesses affected by the coronavirus.

Officials advised business owners to speak to your landlord about your lease.

"Whether they are willing to forgive some of the lease or willing to defer, you need to at least have that conversation," said Mike Daniel, a local business owner and representative of the California Small Business Development Center.

For businesses who have a current loan, ask to defer your loan.

"Every lender is giving an immediate three-month deferment with no penalties," Daniel said.

Daniel also advises business owners to check and see if you have "business income" or "business interruption" insurance. Find out if you can make a claim and if the insurer is going to pay out on that claim. A government shutdown is written in the policy.

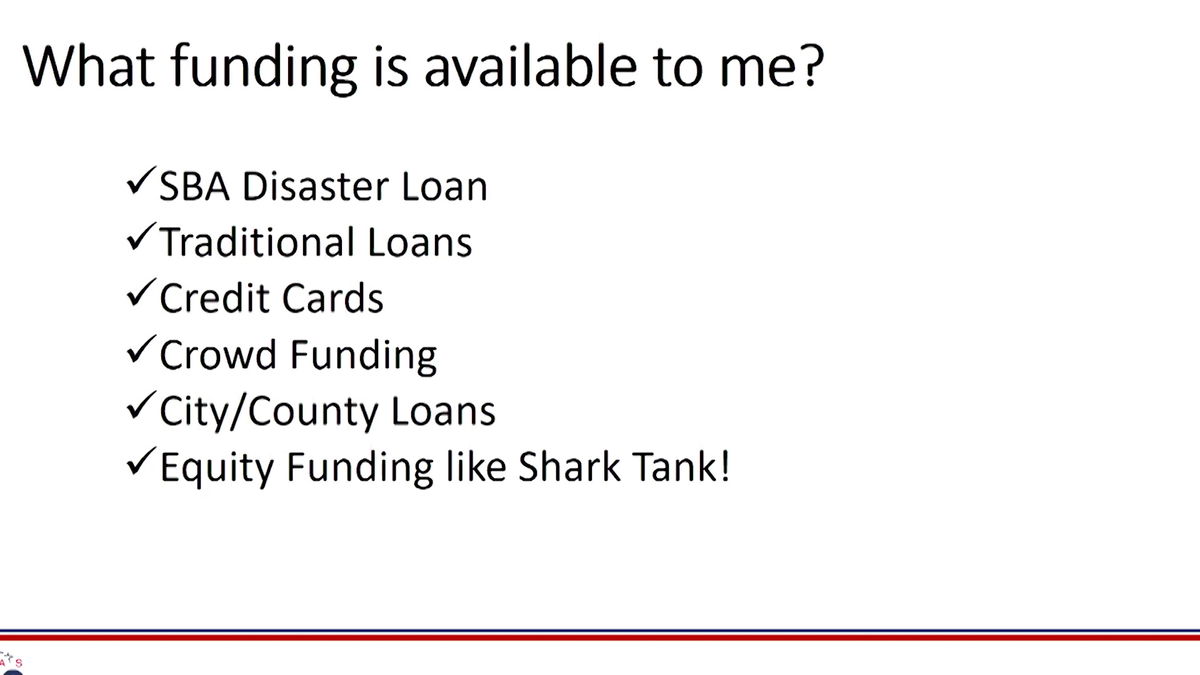

Daniel also reviewed two loan programs that are available to help business, Economic Injury Disaster Loan and Paycheck Protection Program.

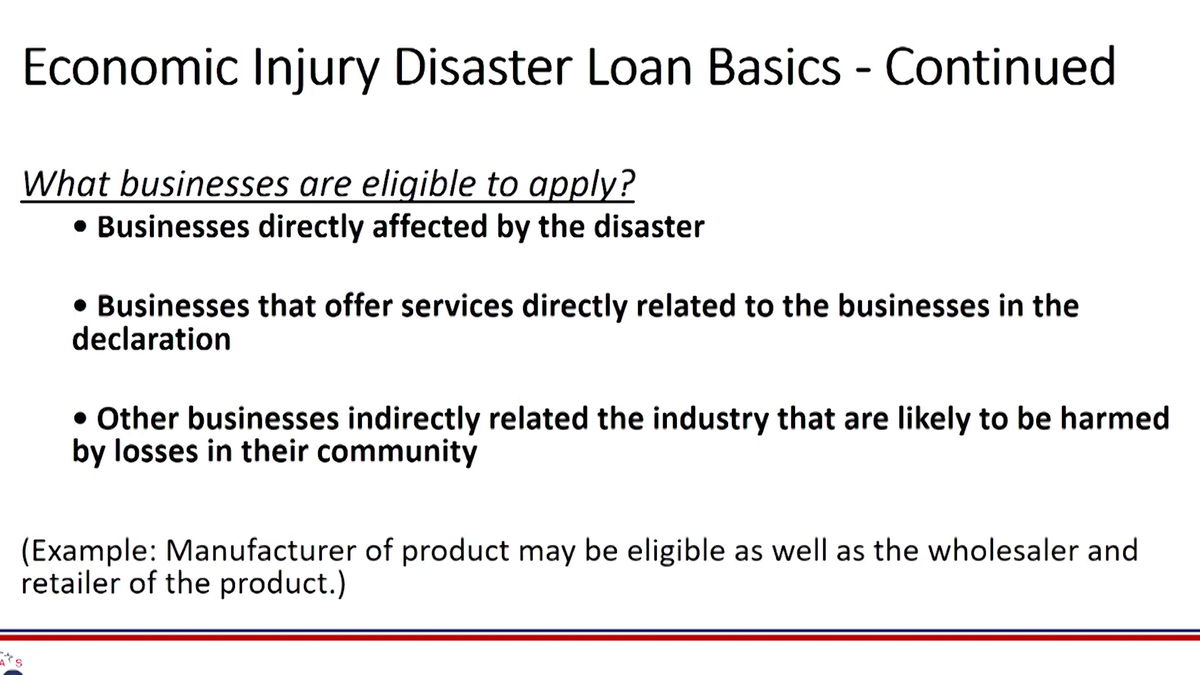

An Economic Injury Disaster Loan from the U.S. Small Business Administration offers low-interest loans for working capital to small businesses suffering as a result of the coronavirus outbreak.

The loan is available to small businesses, small agricultural cooperatives, small aquaculture businesses, and most private non-profit businesses.

Eligibility for this loan is based on size (must be a small business), type of business, and its financial resources.

Those eligible for an Economic Injury Loan may qualify for a loan of up to $2 million. Interest rates are 3.75% for small businesses and 2.75% for non-profits with terms up to 30 years.

Loans of up to $25,000 require collateral. The SBA takes real estate as collateral when available.

Click here to apply for an Economic Injury Disaster Loan (You can also call 800-659-2955)

Officials advise that you submit your application for this loan as soon as you can.

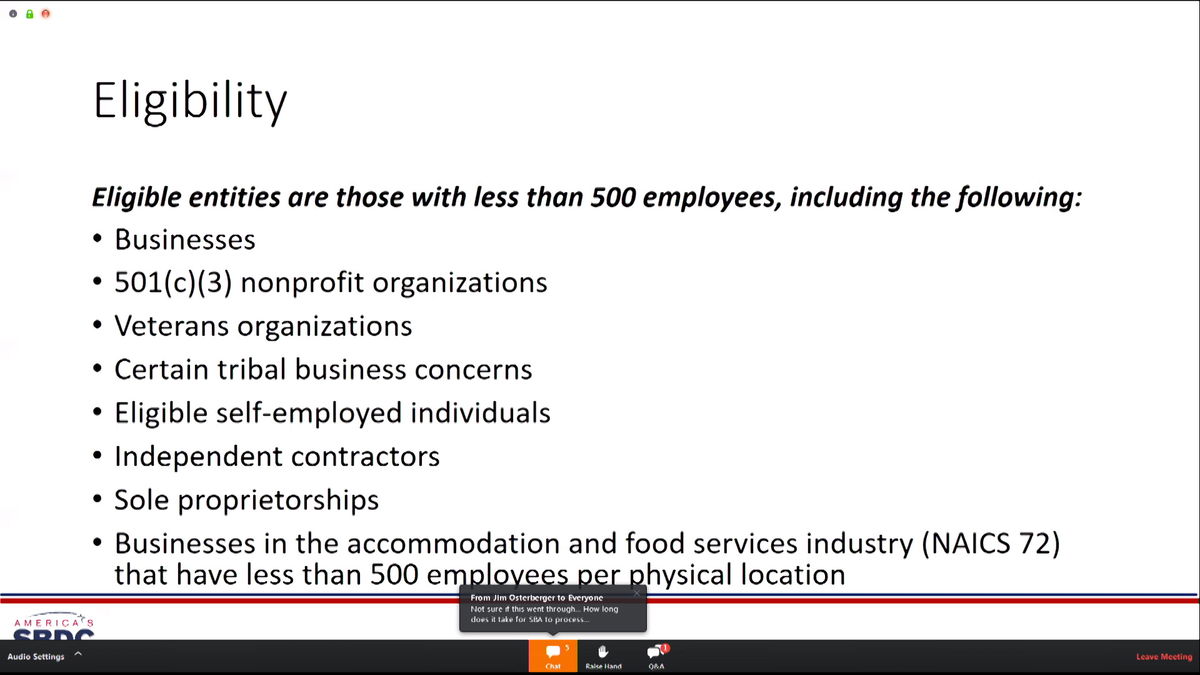

The Payroll Protection Program provides up to $349 billion in loans. The SBA will decide how much you qualify for.

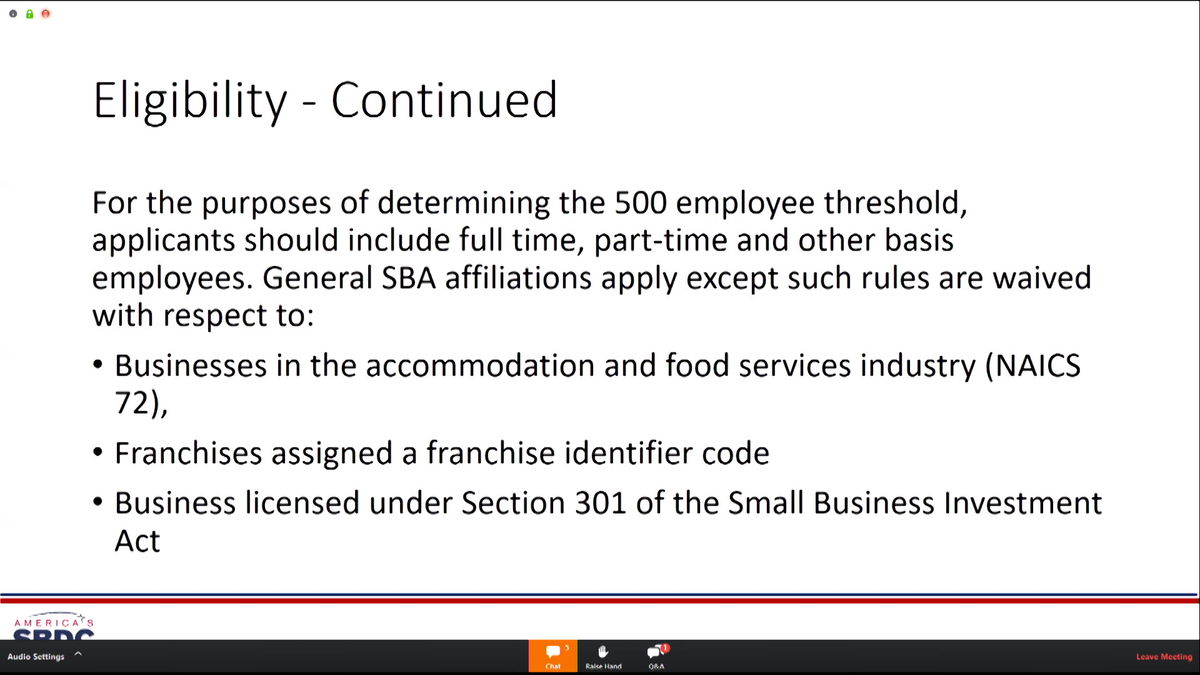

Businesses with fewer than 500 employees are eligible with some exceptions.

Daniel did confirm you will be able to apply for both loans.

Contact the Small Business Development Center at coachellavalleysbdc.org/ or 1 (800) 616-7232 for more information.